When people think about financial operations, they often see AP and AR as routine accounting work. In reality, these two functions control the rhythm of every company’s cash flow. They decide how quickly money leaves the business, how fast it comes in, and how predictable financial planning becomes.

A modern ERP system—like Oracle Fusion—brings structure, automation, and clarity to these workflows. When AP and AR run smoothly, the entire enterprise runs smoothly. When they don’t, everything slows down.

This guide breaks down the AP and AR process in simple, practical language and explains why upgrading these functions is one of the smartest moves a business can make.

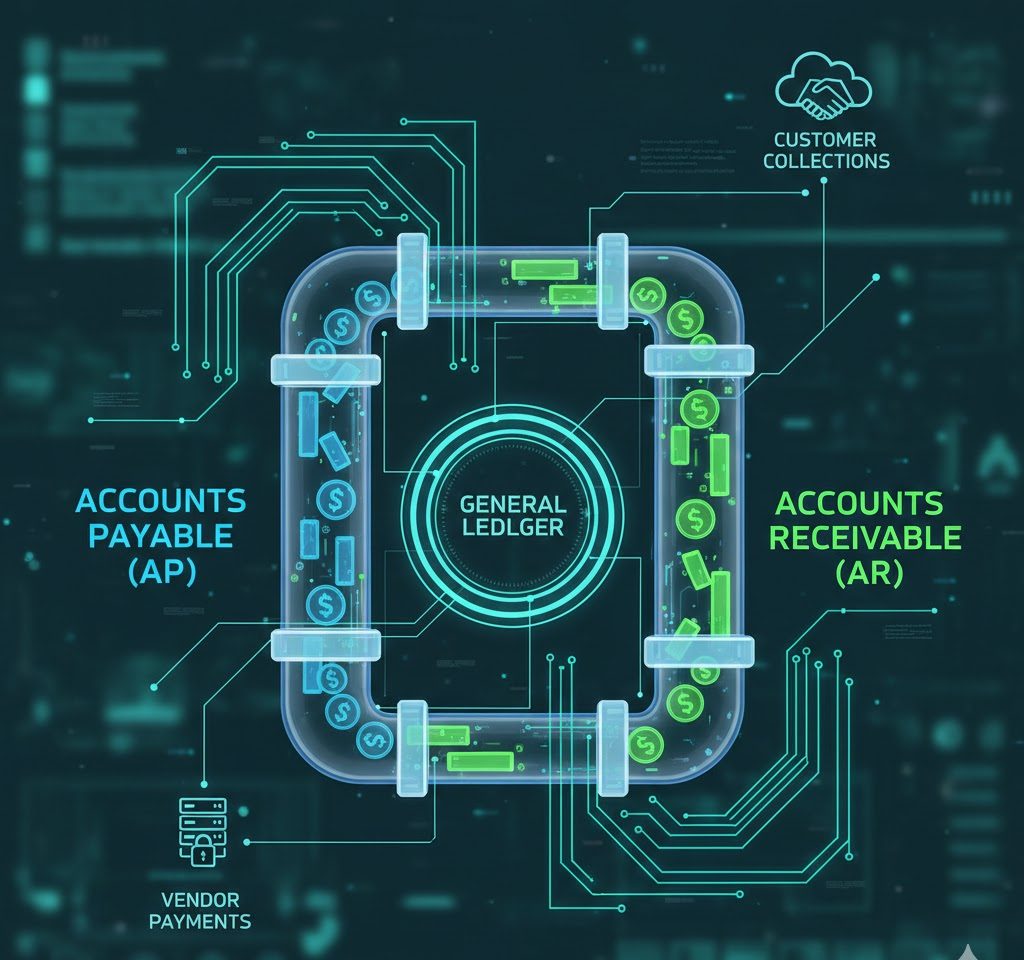

Understanding Accounts Payable (AP)

Accounts Payable manages the money a company owes its suppliers. The goal is simple: pay the right amount, to the right supplier, at the right time.

A typical AP cycle includes:

- Receiving supplier invoices

- Validating the details

- Matching the invoice with Purchase Orders and Receipts

- Routing it for approval

- Scheduling and releasing the payment

- Posting the accounting entries

Modern ERP systems automate most of these steps, reducing manual effort and errors.

Why AP Matters

- Ensures supplier trust

- Reduces late fees or disputes

- Keeps inventory movement smooth

- Improves budget planning

- Provides clear visibility of liabilities

Understanding Accounts Receivable (AR)

Accounts Receivable manages money received from customers. This includes invoicing, collections, receipts, and adjustments.

A typical AR cycle flows through:

- Creating customer invoices

- Sending them through the right channel

- Monitoring outstanding balances

- Tracking disputes

- Collecting payments

- Applying receipts

- Recording revenue

A strong AR process accelerates cash flow and reduces the burden on the finance team.

Why AR Matters

- Keeps incoming cash predictable

- Improves customer experience

- Strengthens financial stability

- Reduces follow-up cycles

- Supports accurate revenue forecasting

Why AP & AR Need a Modern ERP

As a business grows, the volume of invoices increases quickly. Manual spreadsheets and email approvals can’t keep up. That’s when delays, errors, double payments, and reconciliation backlogs start appearing.

A modern ERP solves these issues through:

Automation

Invoices get captured, matched, validated, and routed automatically.

Accuracy

System checks prevent duplicate entries or wrong amounts.

Visibility

Finance leaders see real-time:

- Outstanding supplier dues

- Customer payments

- Cash flow impact

- Upcoming liabilities and receivables

Compliance

Audit histories, tax rules, and controls remain consistent and transparent.

Scalability

ERP systems handle growth without needing a larger finance team.

Real-World Scenario: A Fast-Moving Manufacturing Firm

Picture a manufacturing company buying raw materials every day and delivering finished goods across regions.

Without proper AP:

- Supplier invoices get delayed

- Production gets disrupted

- Suppliers stop offering credit

Without proper AR:

- Customer billing gets delayed

- Collections slow down

- Cash flow becomes unpredictable

With a modern ERP:

- Supplier invoices flow through automatic matching and approvals

- Customer invoices get created instantly after goods ship

- Finance teams track overdue payments in real time

- Leadership sees a consistent cash flow picture

The entire financial loop becomes stable and predictable.

Top Benefits of Using ERP for AP & AR

- Faster Processing

Automated validations and approvals reduce processing time drastically.

- Clean, Accurate Data

ERP prevents errors before they happen.

- Better Cash Flow Control

Leadership clearly sees when money leaves and when it comes in.

- Strong Supplier & Customer Relationships

Timely payments and clear communication build trust.

- Lower Operational Costs

Automation reduces manual work and staffing pressure.

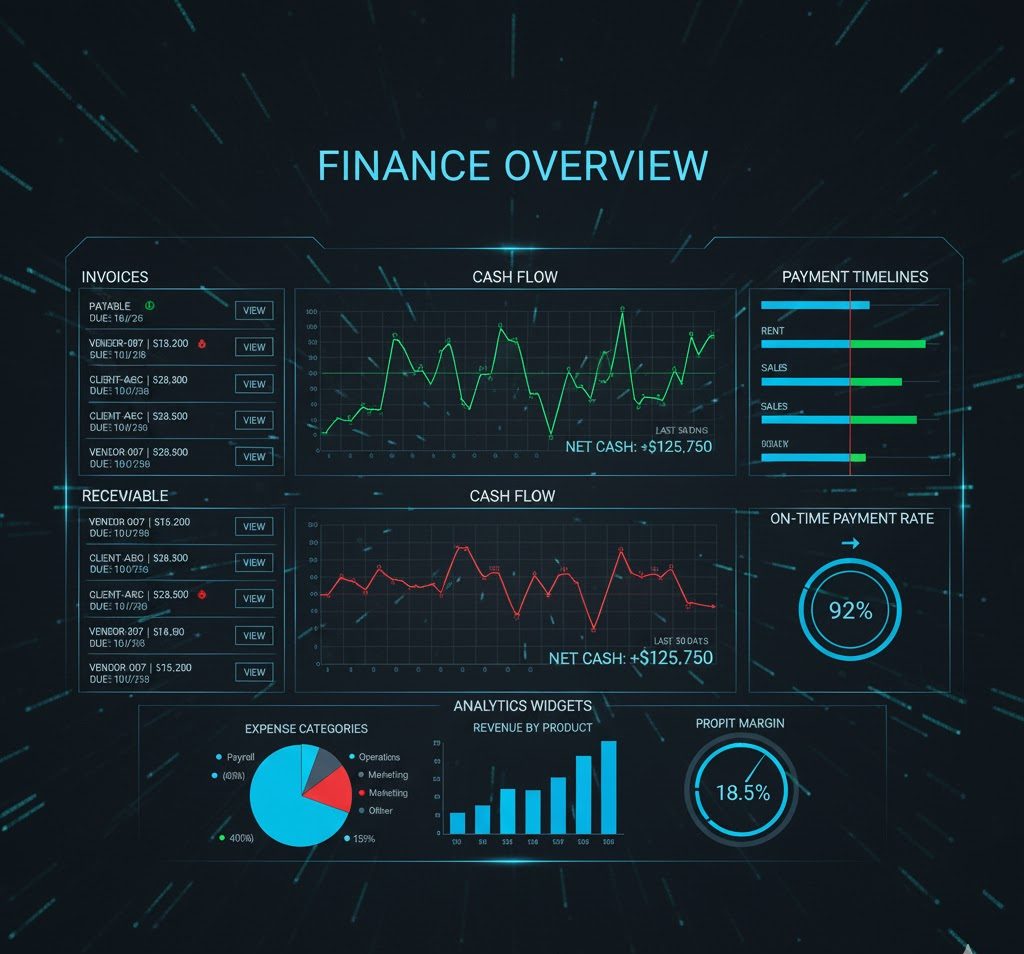

- Real-Time Reporting

Finance teams can close books quicker and make decisions faster.

How Faramond Helps Companies Modernize AP & AR

Faramond works with clients across industries—manufacturing, pharma, BFSI, retail, logistics, and services—to streamline and enhance their financial operations.

Our expertise includes:

✔ ERP Implementation & Optimization

We design AP & AR workflows based on real business processes and industry best practices.

✔ Automation Through Oracle Integration Cloud (OIC)

We remove manual touchpoints by integrating ERPs with:

- Supplier portals

- Customer portals

- Banks

- External billing systems

✔ Custom Extensions with APEX & VBCS

We build user-friendly dashboards, forms, and approval apps without touching ERP’s core.

✔ Real-Time Analytics

We develop clear visual dashboards for:

- AP aging

- AR aging

- Cash flow projections

- Payment performance trends

✔ Process Transformation

We help reduce effort, eliminate delays, and bring consistency to financial operations.

With Oracle at our core and digital engineering in our DNA, Faramond helps companies transform their financial backbone with speed and confidence.

Conclusion

AP and AR are more than accounting tasks—they shape the financial health of every business. When modern ERP controls these workflows, companies gain speed, accuracy, predictability, and trust from their partners.

If your goal is to improve cash flow, reduce operational effort, and strengthen financial decision-making, modernizing AP and AR is one of the smartest investments you can make.

Faramond is here to help you do it right.